Commercial Characteristics for Sale: Trick Insights for Savvy Capitalists

In the existing landscape of business real estate, discerning capitalists need to navigate a complex range of market characteristics and valuation methods to determine lucrative chances. As we explore the complex strategies to reviewing industrial residential or commercial properties for sale, one concern continues to be: what certain strategies can raise your financial investment game in this competitive field?

Understanding Market Trends

Comprehending market fads is vital for making notified decisions in the commercial actual estate sector. Capitalists should evaluate different signs, consisting of pricing patterns, need and supply dynamics, and economic conditions, to gauge the marketplace landscape efficiently.

Secret metrics such as occupancy prices, rental yields, and purchase quantities offer critical understandings right into market wellness. As an example, a climbing occupancy price may signal a boosting need for commercial spaces, prompting investors to think about critical procurements. Conversely, decreasing rental yields could suggest surplus or economic slumps, requiring caution in financial investment approaches.

Furthermore, macroeconomic elements such as rate of interest prices, inflation, and work rates substantially impact business building efficiency. A robust economy generally promotes company expansion, bring about greater demand for commercial rooms. On the various other hand, economic stagnations can reduce need, impacting home values and rental revenue.

Remaining abreast of local and nationwide market trends allows financiers to maximize opportunities and minimize threats. Making use of comprehensive market evaluations and reports can enhance decision-making procedures, enabling financiers to straighten their approaches with dominating market conditions. Eventually, recognizing market trends is critical for achieving success in the competitive sector of commercial realty.

Place Analysis Strategies

Reliable area evaluation methods are vital for identifying the optimal sites for commercial properties. Capitalists must assess various aspects that affect the worth and performance of a location. One primary strategy is making use of Geographic Info Equipment (GIS), which allows for the visualization and evaluation of spatial data, aiding capitalists identify trends and patterns connected to demographics, web traffic flow, and proximity to rivals.

An additional essential technique is website gos to, which make it possible for investors to experience the area firsthand, assessing aspects that might not appear in information alone, such as area dynamics and access. By employing these methods, capitalists can make educated choices that align with their investment approaches, ultimately enhancing their possibilities for success in the affordable industrial actual estate market.

Reviewing Property Value

After carrying out a thorough location analysis, the next step is to review the home worth, which is a fundamental aspect of making informed financial investment decisions. Residential or commercial property assessment incorporates numerous methodologies that offer insight into the property's worth and prospective return on investment.

The 3 key strategies to residential or commercial property assessment consist of the expense technique, the sales contrast method, and the revenue technique. The expense method estimates the value based upon the price to replicate the residential property, minus devaluation. This technique is especially useful for distinct residential or commercial properties or new buildings lacking comparables.

The sales contrast method involves analyzing recent sales of similar residential or commercial properties around. This approach requires an extensive understanding of the local market and can be influenced by market trends, need, and supply characteristics.

Ultimately, the revenue approach is important for investor-focused homes, as it evaluates prospective income generation via rental yields. This approach thinks about net operating earnings and capitalization prices, offering a clear image of monetary stability.

Engaging a specialist evaluator can boost the precision of these examinations, guaranteeing that capitalists make decisions based on reliable data and market facts.

Assessing Investment Dangers

Financial investment risks in industrial residential property purchases can dramatically impact potential returns and overall monetary stability. Financiers must carry out extensive due persistance to identify and reduce these threats effectively. Secret factors to consider consist of market variations, tenant dependability, and property-specific problems.

Market threats, consisting of economic recessions and modifications in regional need, can affect home worths and rental income. Comprehending the financial indications and patterns in the area can assist capitalists prepare for possible decreases. Lessee integrity is an additional essential factor; buildings with lasting, secure lessees usually existing reduced dangers. Examining occupant monetary health and wellness and lease terms is vital for examining this element.

Property-specific risks, such as maintenance concerns or zoning adjustments, can additionally pose obstacles. An in-depth inspection and an understanding of neighborhood regulations can click to find out more uncover potential liabilities that may not be promptly evident. Additionally, ecological risks, such as contamination or all-natural disasters, should be examined, as they can result in substantial monetary burdens.

Funding Options Available

Navigating the landscape of funding alternatives is essential for investors seeking to acquire business residential or commercial properties. Understanding the various financing methods readily available can dramatically influence financial investment returns and general success.

For those looking for a lot more adaptable terms, exclusive lending institutions visit our website or hard cash lendings can be a practical choice. These sources typically accommodate investors that might not meet conventional requirements, though they come with higher interest rates and much shorter settlement durations. Furthermore, government-backed finances, such as those supplied by the Local business Management (SBA), can offer lower down payment alternatives and desirable terms for certifying services.

Eventually, investors must review their monetary situations, risk resistance, and long-lasting goals to pick one of the most appropriate financing alternative for their industrial property financial investments. Cautious consideration will certainly make sure that they maximize their possible for productivity and success.

Final Thought

In final thought, successful investment in commercial homes necessitates a thorough understanding of market patterns, reliable location analysis, and exact building assessment. By methodically examining investment dangers and exploring varied funding choices, capitalists can improve decision-making procedures and improve prospective returns. A tactical strategy, grounded in complete research and analysis, inevitably increases the probability of attaining beneficial outcomes within the competitive landscape of business websites property.

In the present landscape of business real estate, discerning financiers have to navigate a complicated selection of market dynamics and appraisal methods to recognize lucrative chances. A climbing tenancy rate may indicate a raising need for commercial spaces, triggering financiers to take into consideration strategic purchases.Staying abreast of nationwide and neighborhood market fads permits investors to capitalize on opportunities and reduce dangers. Using detailed market evaluations and reports can improve decision-making processes, allowing financiers to align their techniques with prevailing market conditions. By systematically assessing investment risks and discovering varied funding choices, financiers can improve decision-making processes and enhance prospective returns.

Neve Campbell Then & Now!

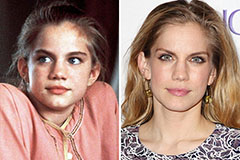

Neve Campbell Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!